BRICS+ and Mortar: Cementing A Growing Consortium With Powerful Bilateral Partnerships

In the dawn of 2024, Brazil and China are not just trading partners; they're setting a precedent for how emerging markets can redefine power dynamics on the world stage.

China and Brazil Rewrite The Book on Trade For Emerging Markets

New Year’s Day 2024 was a milestone for the BRICS Consortium. Six new nations were set to join Brazil, Russia, India, China and South Africa. The 21st century trade partnership already represents 40% of the world’s population and more than 25% of global GDP. With the addition of Saudi Arabia, Iran, Egypt, Ethiopia, and the United Arab Emirates (Argentina reversed itself and decided not to join), this now 10-nation alliance will control nearly 30% of world GDP in 2024. No one seems troubled by having to come up with an awkward new acronym (“BRICS+” is the frontrunner). The more important story is that growth is happening at all levels: new members, greater volume, and significantly increased value for key bilateral relationships. Brazil and China are stand-out examples. In 2023, Brazil's strength in commodities combined with China’s technology dominance delivered a partnership with huge valuation and equally important strategic significance.

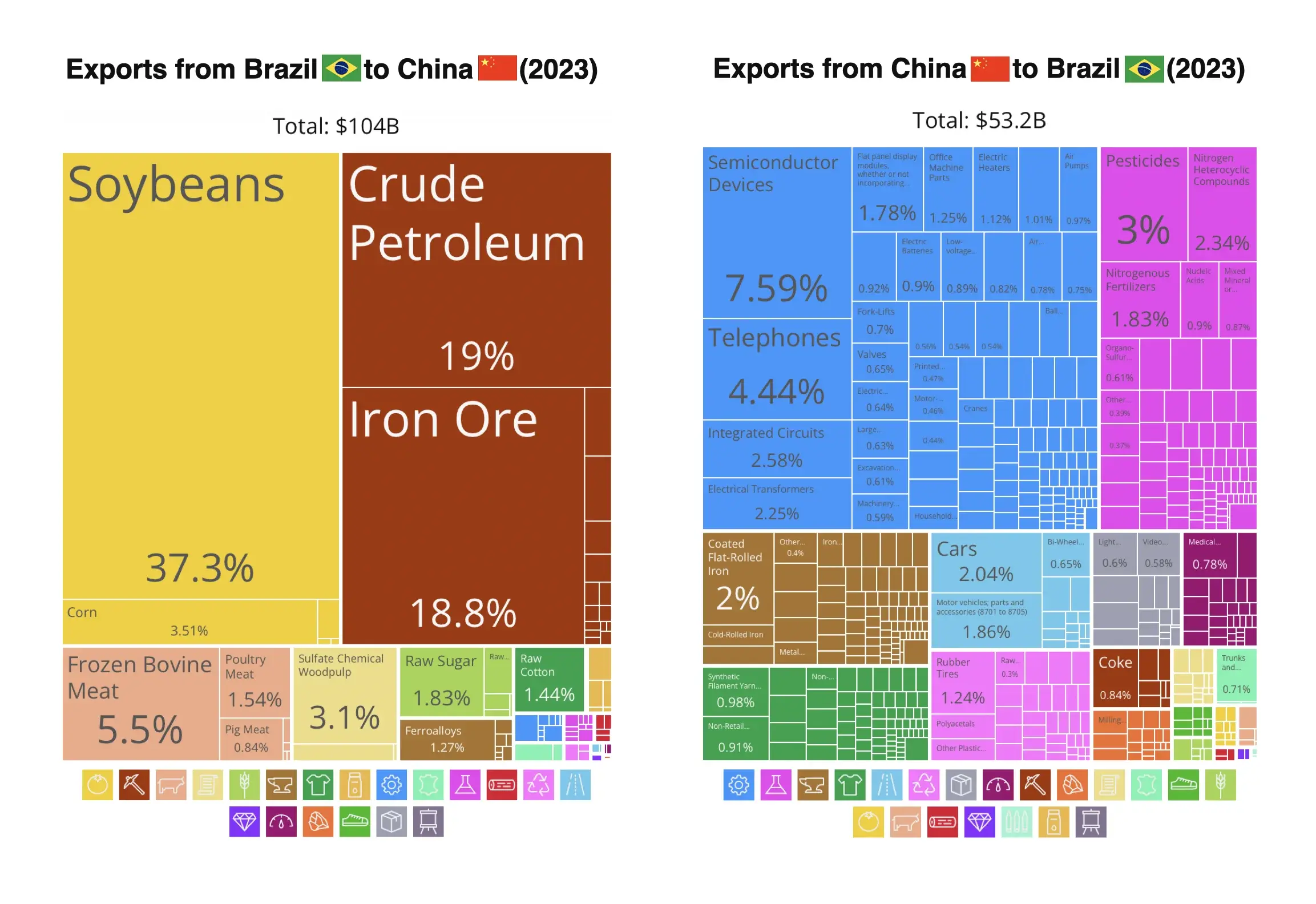

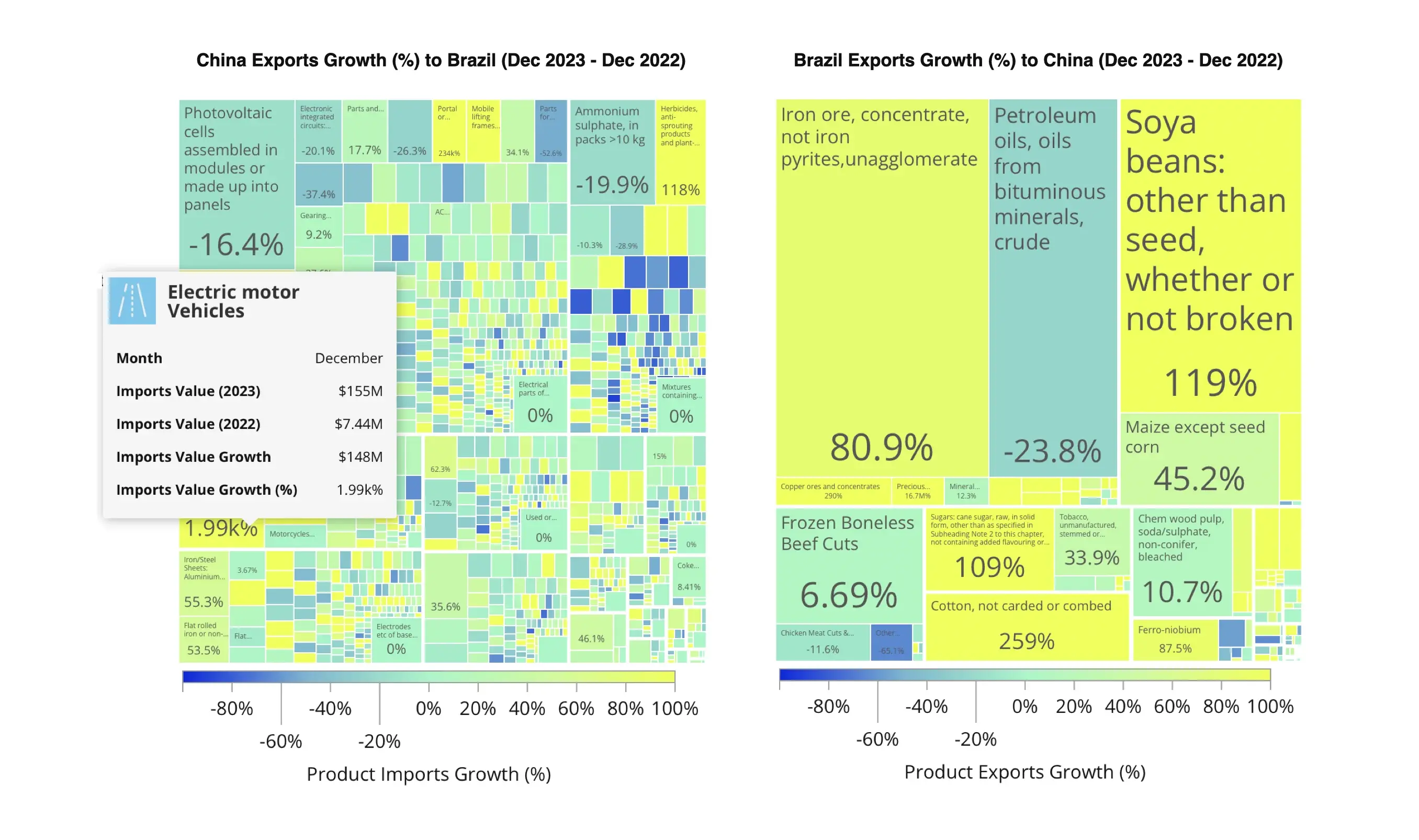

Here are some impressive numbers. Brazilian soybean exports to China reached nearly $39 billion with oil and iron ore sales each spiking at almost $20 billion. Brazil imported over $4 billion in semiconductor devices and $2.36 billion worth of telephones. China also sold Brazil sizable quantities in a range of other electronic components.

Brazil, rich in natural resources, perfectly and profitably complements China's insatiable demand for raw materials. Brazil's commodities more than finance its reliance on Chinese high-tech imports, led by huge demand for electric vehicles. The partnership nurtures mutual prosperity rather than deepening dependence. China enables Brazil to meet the challenge to diversify while Brazil helps to broaden China's role as a key player in the western hemisphere.

The BRICS Identity: An Engine Driving Economic Complexity

The BRICS consortium is an economic alliance free of the ideological constraints that characterized the 20th-century Cold War economy. It is a blend of interdependence and strategic pragmatism. Within this diverse group, distinct supply strengths link to distinct production demands with the effect of leveraging a collective influence on the global economy.

In the China/Brazil example a complementary relationship extends beyond trade figures. This bilateral partnership bypasses political instability in Brazil and superpower tensions between China and the US. The key question going forward is how this Brazil/China relationship and the successful BRICS model generally will contribute to global sustainability goals such as poverty reduction and reducing carbon emissions or if its prosperity comes at the expense of those goals.

Capitalizing on Niche Markets: Brazil's Strategic Shift in Exports to China

Early indications are encouraging. Brazil is enriching its own complexity by making inroads into the trade of high value industrial centrifuges, crucial in pharmaceuticals, food processing, and mining, They rank 169th in the Product Complexity Index (PCI), and in 2021, were the 37th most traded product worldwide, with a total trade value of $88.1 billion.

Here Brazil has carved a slice worth $313 million of which $42.4M (13.5%) went to China. By 2023, these exports surged to $602M, with China's share jumping to $227M, representing 37.6% of Brazil's total exports of this product. The number will only rise as China is the world’s third-largest importer of centrifuges. Despite being a relatively small percentage of Brazil's total exports to China, which stood at $95.4 billion in 2023, centrifuge exports are a strong signal that Brazil can significantly diversify its trade portfolio.

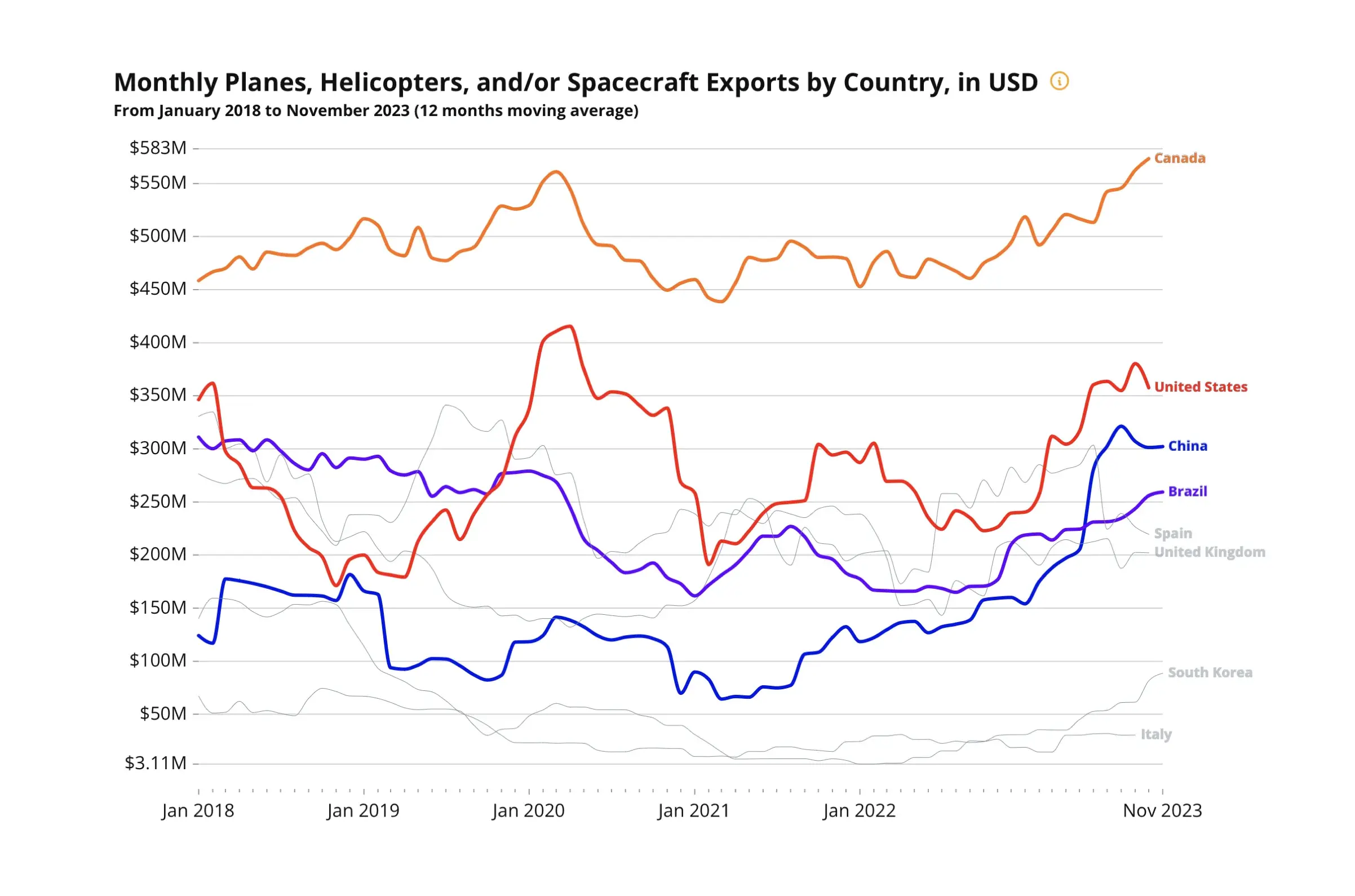

But it's not the only diversification signal of Brazil’s opportunities in China. Over the past decade, Brazil has become the world's 8th largest exporter of planes, helicopters, and spacecraft. Brazil’s 2023 aerospace sales were nearly $3 billion. While the United States and Canada are primary customers, Brazil's 1.5% aerospace exports to China are a significant, BRICS-driven foothold in a competitive and high-value market.

Future Outlook: Balancing Trade and Self-Reliance

The path ahead for Brazil involves leveraging insights from economic complexity to inform strategic decisions in technology and innovation. For China, as it transitions into a more consumption-oriented economy, the Brazilian lifeline promises to ensure uninterrupted production in China’s industrial base while Beijing adapts to rapidly changing domestic economic priorities. These two “bricks” in the increasingly durable BRICS trade structure are rising on the global trade skyline. As BRICS evolves into BRICS+ with its new members in 2024, the trade relationship between China and Brazil represents an important model for other partners in this alliance that the rest of the global economy simply cannot ignore.