When China and the US Have a Trade War, Mexico Wins

The US-China trade is causing some companies to look for Mexico as an alternative to sourcing from China.

The "Three Amigos" summit held in Mexico City brought together the US, Mexico, and Canada in an agenda filled with concerns about illegal immigration, drug trafficking, and energy security. But the summit also offered opportunities to capitalize on a fantastic year of trade between Mexico and the US.

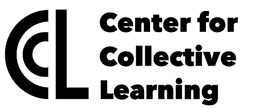

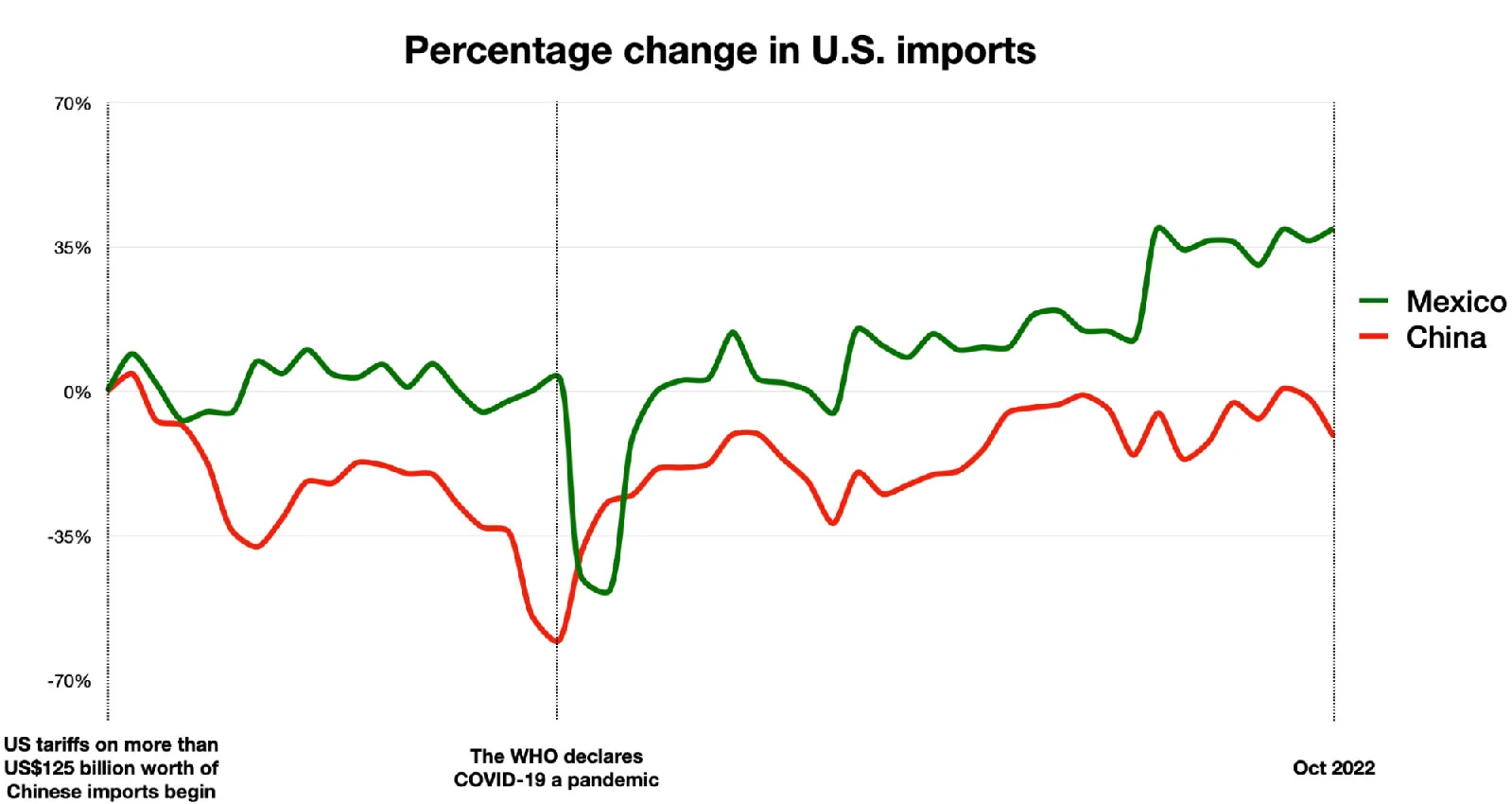

In October alone, U.S. imports from Mexico increased by 17.5% compared to last year, while U.S. imports from China decreased by 7.2%. This shift is even more substantial in vehicles and electronics, which increased respectively by 25.8% and 24.3%

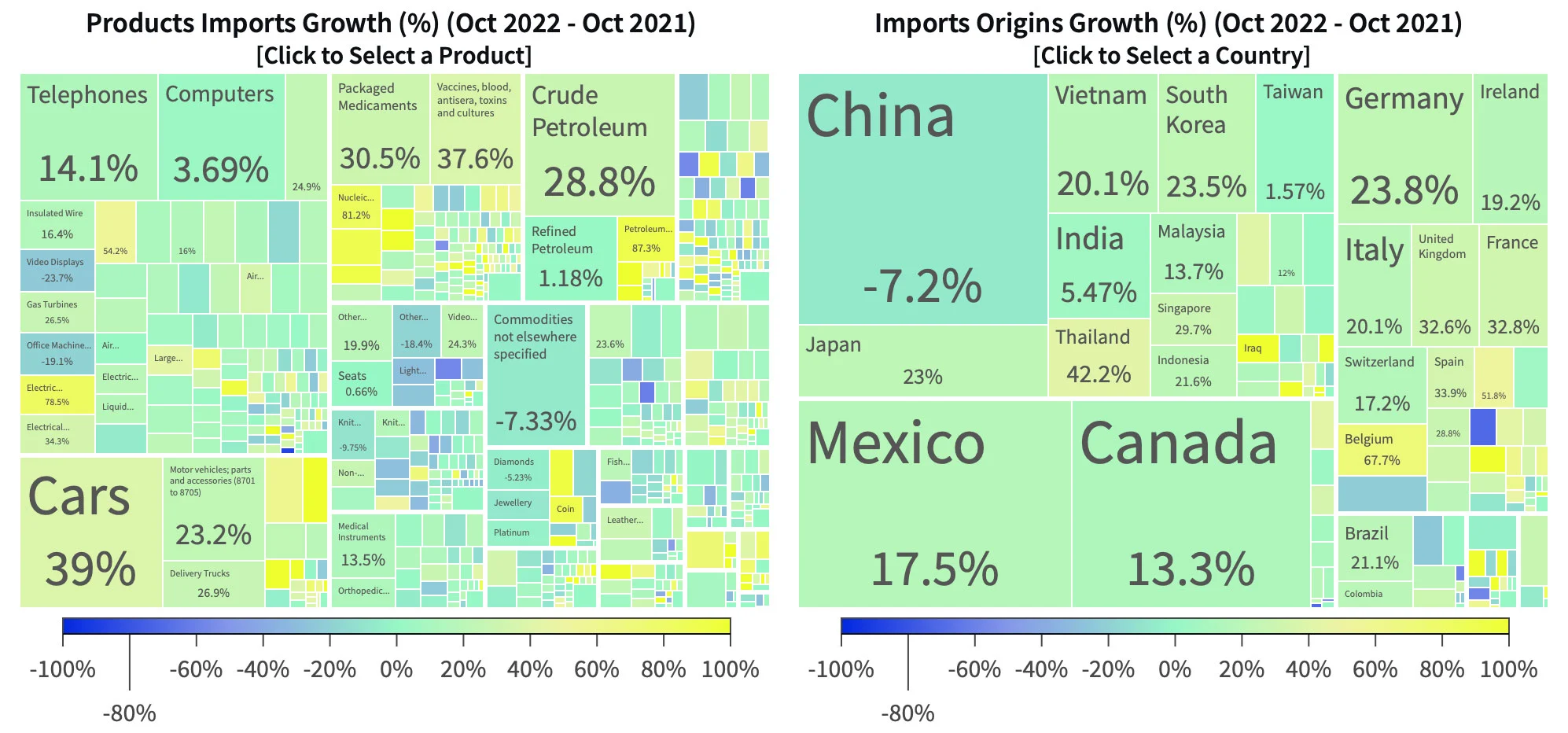

Trade wars affect supply chains. In 2022, this involved a clear shift in US imports from China to Mexico and other “substitute” countries, such as Malaysia, Taiwan, and Thailand, which increased their exports to the U.S. and the rest of the world.

China has long been the world's leading manufacturer, but the pandemic, the trade war, and rising wages have caused some manufacturers to look for alternatives. Mexico is an increasingly attractive option for the US due to its physical proximity, favorable trade agreement, and decades with a strong manufacturing tradition. As a result, some U.S. companies, such as Walmart, Samsung, Amazon, and Dell, have decided to move their supply chains to Mexico as an alternative to China.

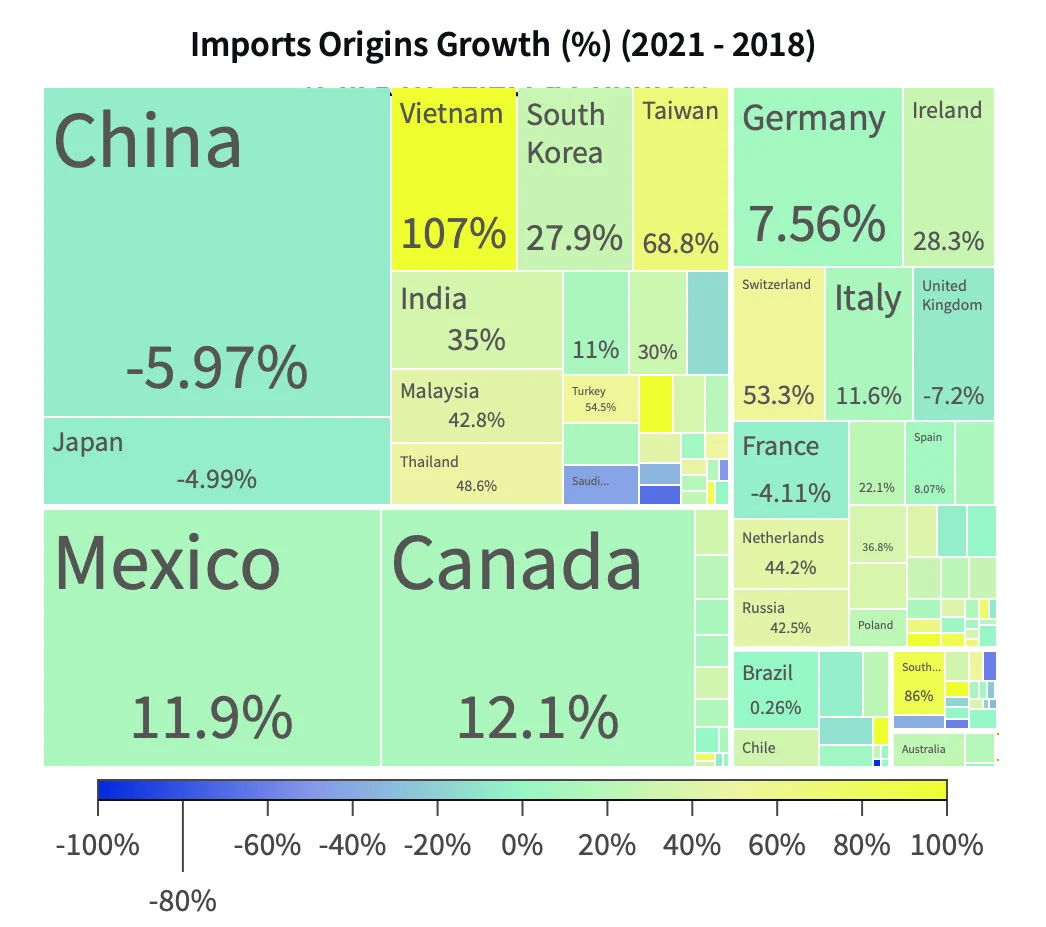

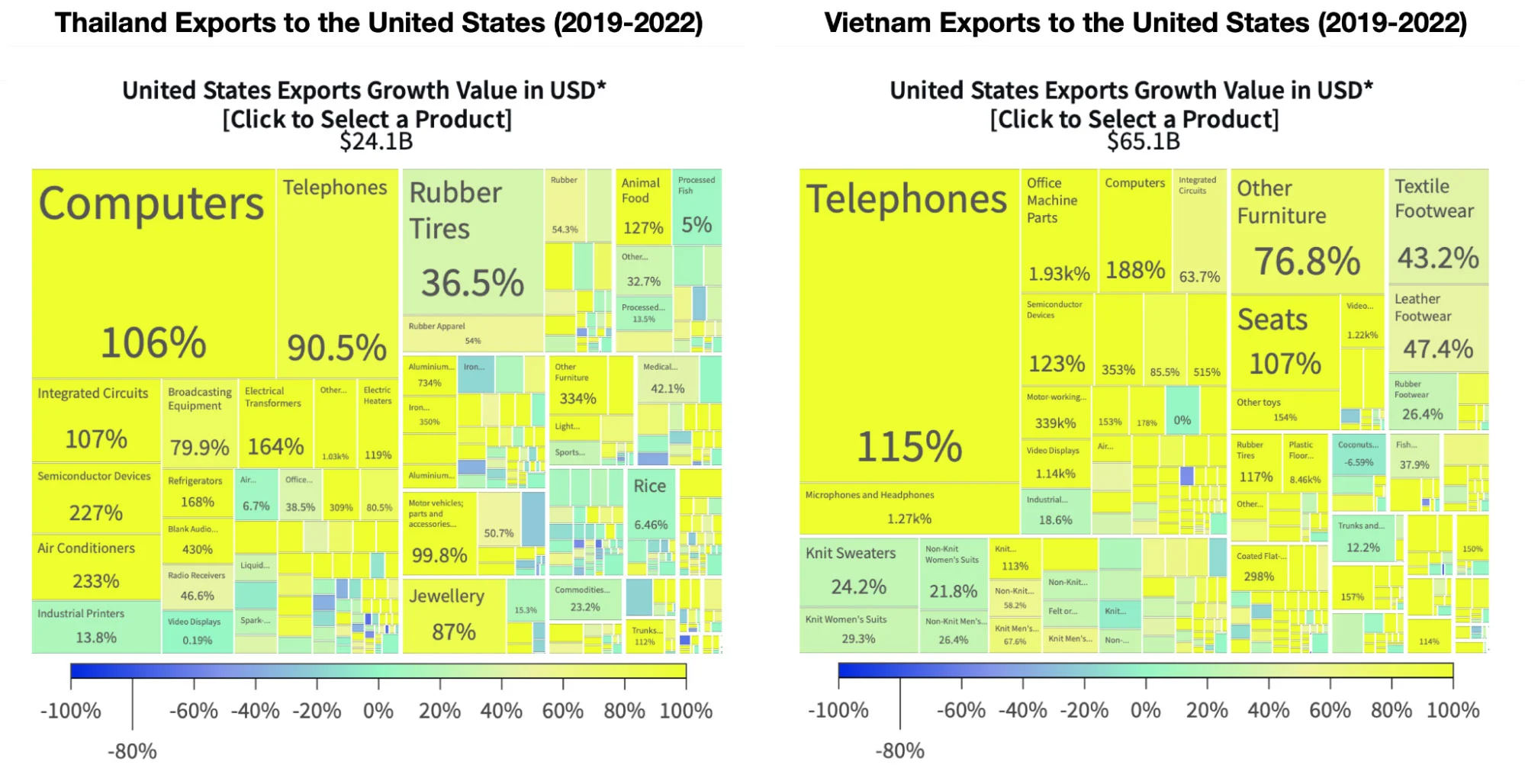

The trade war has also impacted the U.S. auto parts industry and home furnishings market, benefiting exporters in Thailand and Vietnam.

But the shifts in trade are not only limited to products facing high tariffs. U.S. computer imports from China, a product with a U.S. tariff of zero, have decreased by $3.4 billion, while imports from Mexico have increased by $9.2 billion.

Manufacturing between the U.S. and Mexico is highly integrated. For some companies, the uncertainty created by the trade war was enough to shift. For example, Dell, the computer manufacturer, announced in 2019 that it was opening a new manufacturing facility in Mexico to reduce the impact of tariffs on its supply chains in the U.S.

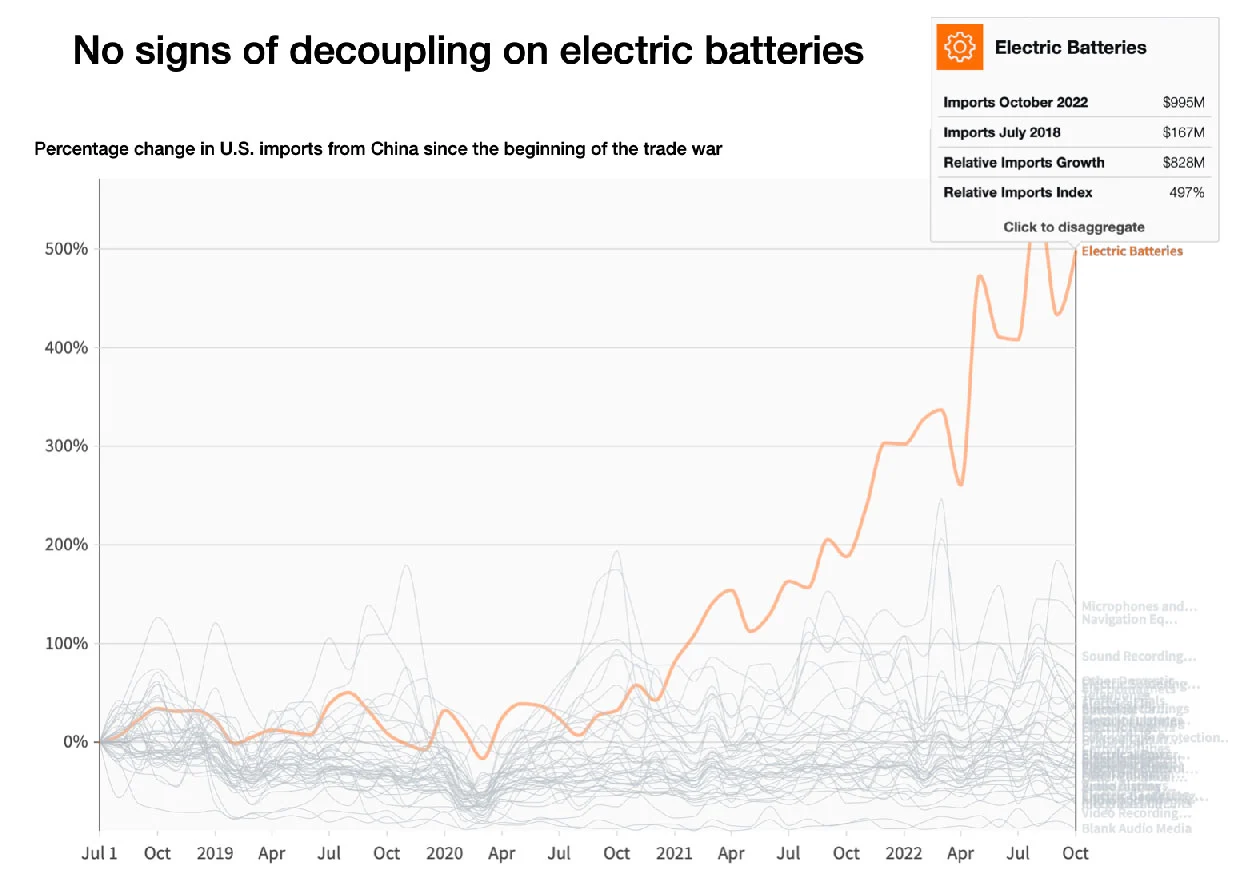

Dell's shift to Mexico came with challenges, including a rapidly changing market about to burst. In 2020, U.S. imports of laptops, computers, phones, and headphones from China were higher than ever. Stuck at home, consumers switched their spending away from services and toward electronics. But as the market has shifted and the trade war tariffs continue, the U.S. has decreased its reliance on China.

Currently, China accounts for 18% of U.S. imports, down from 22% at the beginning of the trade war. Conversely, U.S. imports from Mexico have increased by 38% from pre-trade war levels and have recovered well following the pandemic.

Regional value chains are gaining popularity as a sustainable and resilient alternative to global value networks. They provide economic benefits for local producers and consumers and can help increase Mexico's share of the North American market. Developing more robust regional value chains can also lead to the growth of new industries in Mexico, such as electric mobility and clean energy, resulting in good manufacturing jobs.

In addition, robust regional value chains are advantageous for the United States and Canada. As Mexico's manufacturing sector expands and develops economies of scale, specialization, and internal competition, it strengthens the resilience and competitiveness of the entire North American region.

By working together, the Three Amigos can identify areas where their countries have complementary capabilities and could develop supply chain networks that rely more on local and regional sources. By investing in infrastructure, supporting domestic suppliers, and promoting digital technologies like DataMexico, the supply chains in North America can become more resilient and competitive.