Electrifying Times: The Surge of the Electric Mobility Revolution

The electric mobility revolution is gaining momentum, driven by increasing exports of electric vehicles, bikes, and buses. This is how supportive policies and supply chain challenges shape the future of sustainable transportation.

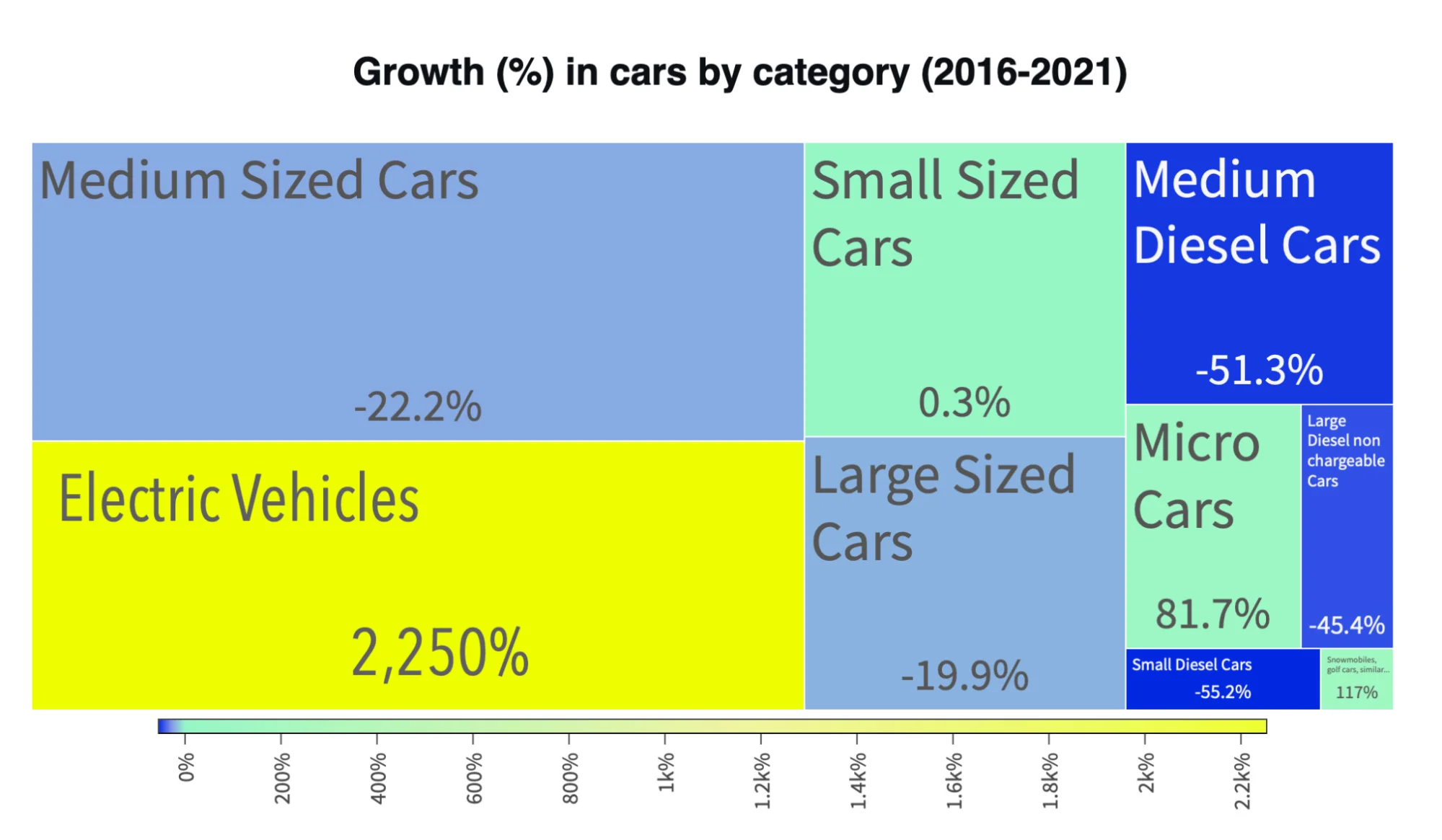

The electric mobility revolution is accelerating. In 2021, electric car exports rose by 76.4%. Electric bikes (30.6%) and buses (12.8%) also thrived. Government incentives and people seeking eco-friendly alternatives are pushing demand. But the quest to retire the internal combustion engine (ICE) may have a sustainability problem of its own: an increasingly stalled-out supply chain.

The United States saw an increase of 178% in the number of imported electric cars. In Norway, a global leader in electric vehicle adoption, the market share of electric cars in comparison to all car imports is now over 70%. The pandemic hasn't diminished exports despite the significant supply chain challenges in the auto industry. During the last four years, electrifying transportation has thrived even in a global headwind.

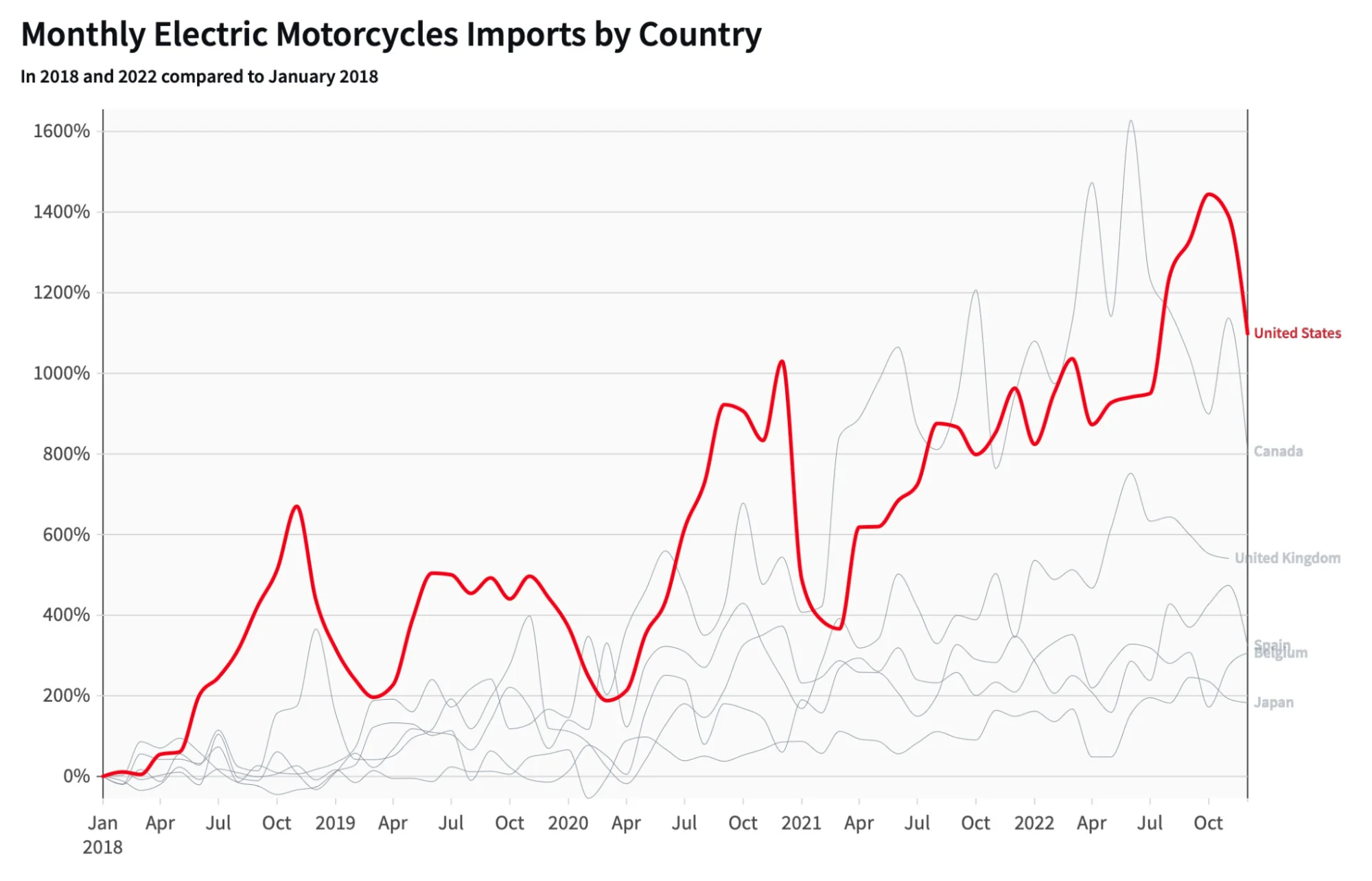

Countries increasingly promote zero-emission vehicles and sustainable transportation through conventional car sale bans, increased purchase incentives, and electric mobility infrastructure development, catalyzing a shift towards eco-friendly alternatives beyond electric cars. Here is a mind-blowing stat: Imports of electric motorcycles and bikes to the United States have grown by 1,100% in the last five years. The electric mobility revolution is picking up at a pace not seen before in the industry.

Competitive Landscape in Electric Mobility Component Production

Just as the intense G-forces generated by rocket speeds can incapacitate pilots, the rapid surge in demand for electric mobility components has created significant challenges for the supply chain, which is different from the traditional ICE supply chain.

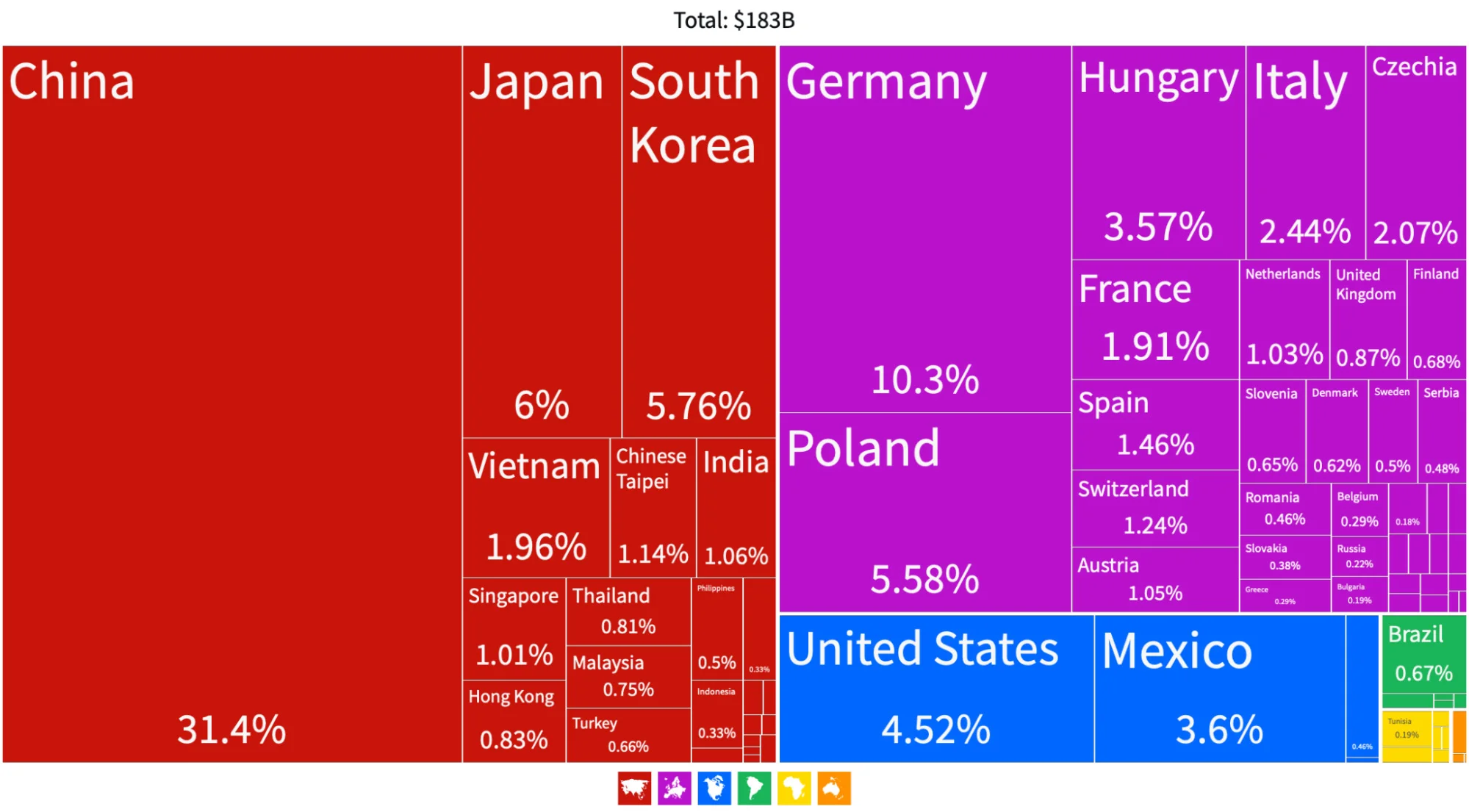

Take, for example, parts for electric vehicles. EV parts are mechanically simpler than ICE but technologically more complex. The most valuable component of an EV is its energy source, the battery, representing about 40% of the total value. And only a few countries produce electric batteries for vehicles. By contrast, the fuel tank for an ICE vehicle is a hunk of metal worth 1-3% of its value and manufactured by several countries.

Reducing the cost of batteries was crucial for making them affordable and competitive. From 2010 to 2021, lithium-ion battery pack prices dropped by 88%, making electric mobility options more competitive and accessible.

Another important vulnerability is that the electric mobility supply chain is more geographically concentrated than the ICE supply chain. Asia and Europe dominate the global production of critical components for electrification, such as batteries and electric motors, accounting for 80% of the market share in 2021. North America has an enormous task ahead to catch up in local production capacity and to reduce heavy reliance on imports from Asia.

This geographical imbalance is changing how EV manufacturers and suppliers factor in logistics costs, trade barriers, environmental footprint, and supply chain resilience. For example, trade tensions between significant markets in China, Europe, and the U.S. quickly disrupt supply chains causing price spikes and halting consumer purchases.

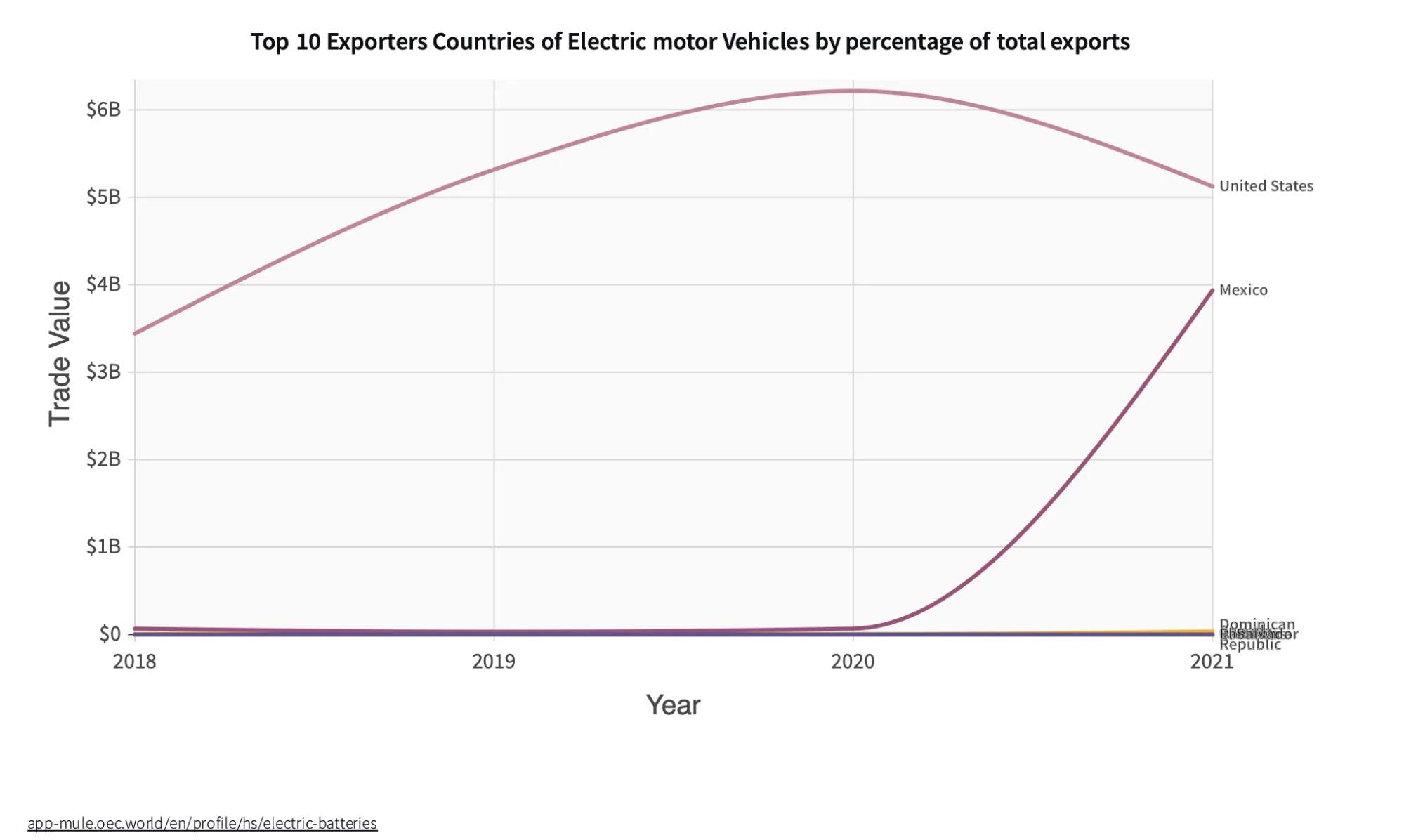

It has taken years of supply chain disruption to finally motivate companies to seek alternative sources of raw materials, components, and finished products for electric vehicles and batteries.

Tesla is increasing the production of critical components and manufacturing in the United States and Mexico. The EV company plans to build a new battery factory in Texas to produce its battery cells using locally sourced lithium from Nevada. Tesla is also expanding its vehicle production capacity in the U.S. and in Monterrey, a thriving manufacturing hub 600 km from Austin that could begin producing EVs next year.

The electric mobility revolution is transforming not only how we move but also how we produce, source, and deliver mobility products. Companies are adapting their operations based on demand, regulatory requirements, and recent experiences with supply chain bottlenecks. As the world increasingly embraces electric mobility, a more sustainable and resilient supply chain will be crucial to success in this revolution.