Bottlenecks in the Fertilizer Industry are a Threat to the Food Supply

The war in Ukraine, rising energy costs, and restrictive trade policies have reduced fertilizer supplies while raising prices. While the repercussions of shortages will be felt globally, some countries like India and Brazil are among the most impacted.

Fertilizers are an essential component of food production. Research shows that the average percent of yield attributed to fertilizer inputs range from 50 to 60%. In other words, mineral fertilizers are responsible for more than half of what we eat.

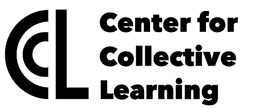

Although fertilizer use is determined by soil composition and crop type, fertilizer exports and imports are highly concentrated. Only a few countries, for example Russia, China, Canada, Morocco, and the United States, export about half of the world's fertilizers, whereas Brazil and India purchase a quarter of global exports.

Almost 70% of all fertilizers used in Brazil and India are imported. Because India and Brazil are the world's third and fourth largest food producers, fertilizer availability in these nations is essential to the global food supply.

The supply chain for fertilizers has experienced a significant shock as a result of the invasion of Ukraine. However, the fertilizer market is susceptible to disruptions mainly for three reasons: access to minerals, costs of raw materials, and logistics.

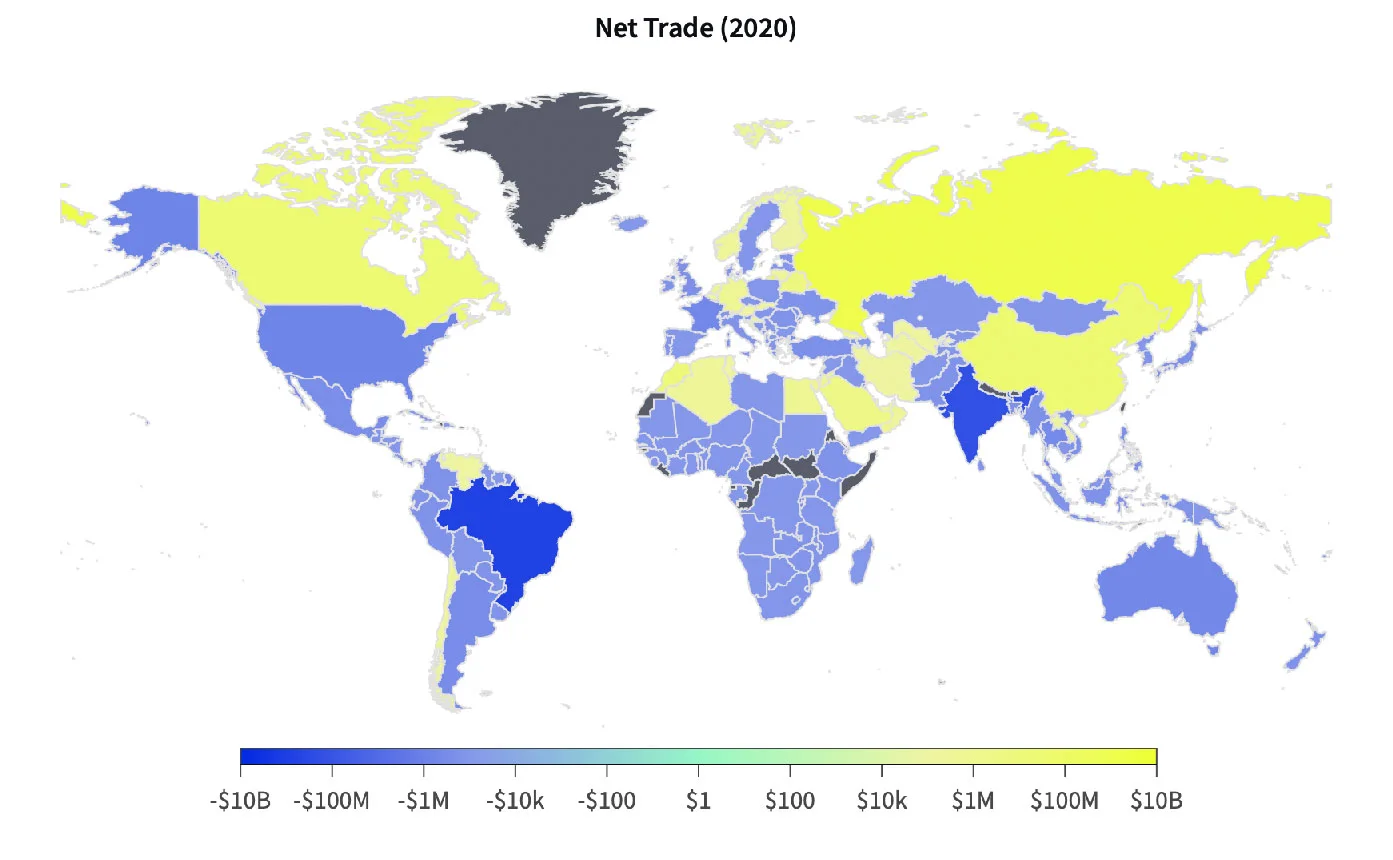

Nitrogen is abundant, but phosphate and potash exist in just a handful of countries. The top phosphate exporters (Morocco, Egypt, and Jordan) account for 39% of phosphate fertilizer exports. In contrast, the countries with two-thirds of the world's potash reserves (Canada, Belarus, and Russia) account for 62% of potash fertilizer exports.

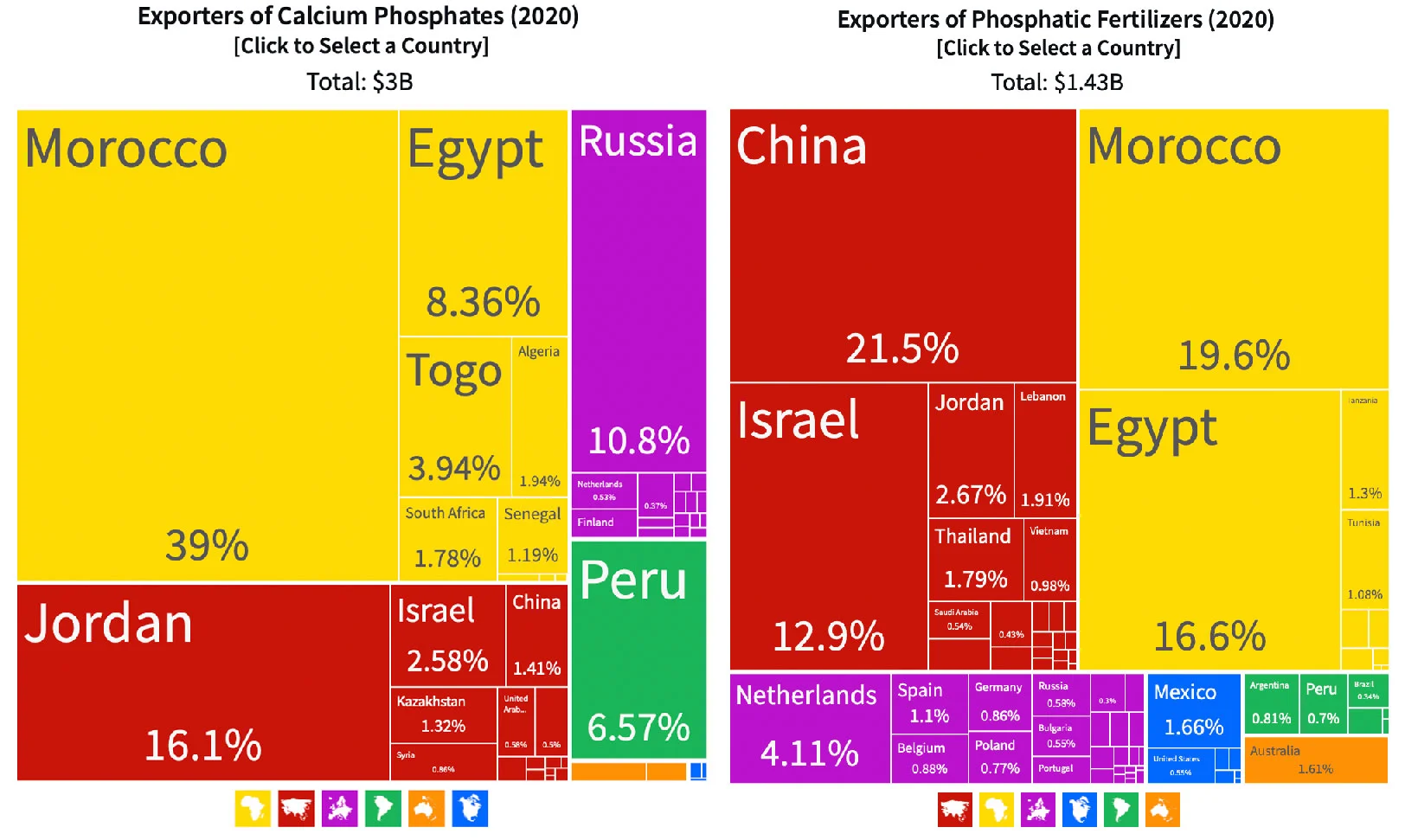

The volatile costs of inputs to manufacture fertilizers, particularly energy, make the market susceptible to disruptions. Natural gas or coal are crucial components of nitrogen fertilizers. Because nitrogen fertilizersrequire processing nitrogen from the air at high temperatures, countries with gas and coal, like Russia, China, and Qatar, have a competitive advantage.

Finally, the logistics in the fertilizer value chain are spread out over large distances. Ammonia, for example, is a critical ingredient for fertilizers. Russia accounts for one-fifth of worldwide ammonia exports. However, a pipeline transporting ammonia from Russia to Ukraine's Odessa was shut down following the invasion. Additionally, delays in the Black Sea have raised costs and uncertainty.

Furthermore, economic sanctions against Russia have pushed countries like India and Brazil to get fertilizers from other suppliers. Additionally, in response to the economic sanctions from Western countries, Russia has imposed restrictions on nitrogen fertilizer exports.

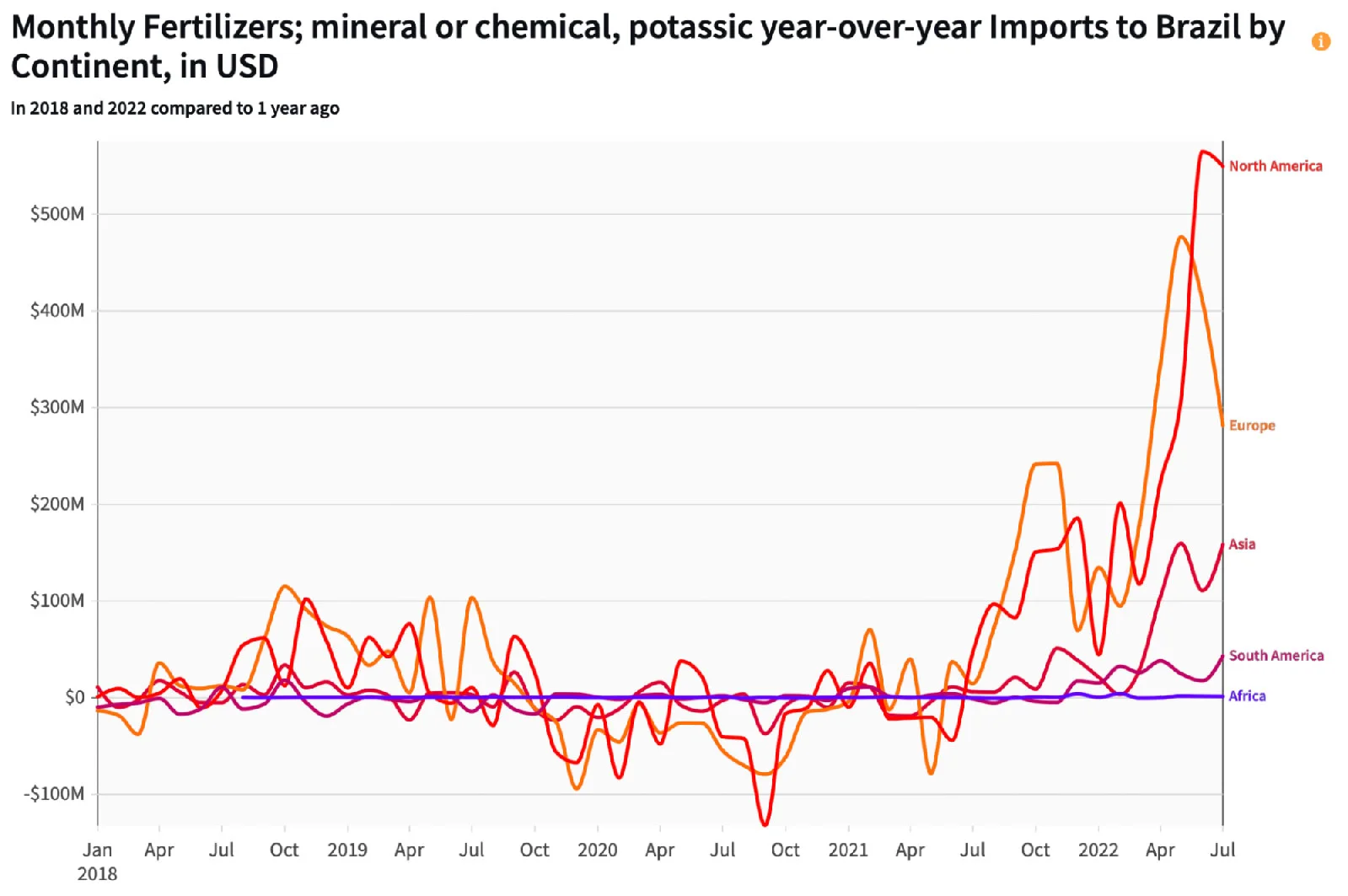

But changing to new suppliers is not easy and requires government coordination. Brazil, for example, launched a National Fertilizer Plan to find new suppliers and reduce external dependence on various types of fertilizers in the medium and long term –from 85% to about 50%. In addition, as the soil in Brazil is potash deficient, they need to import more of that mineral.

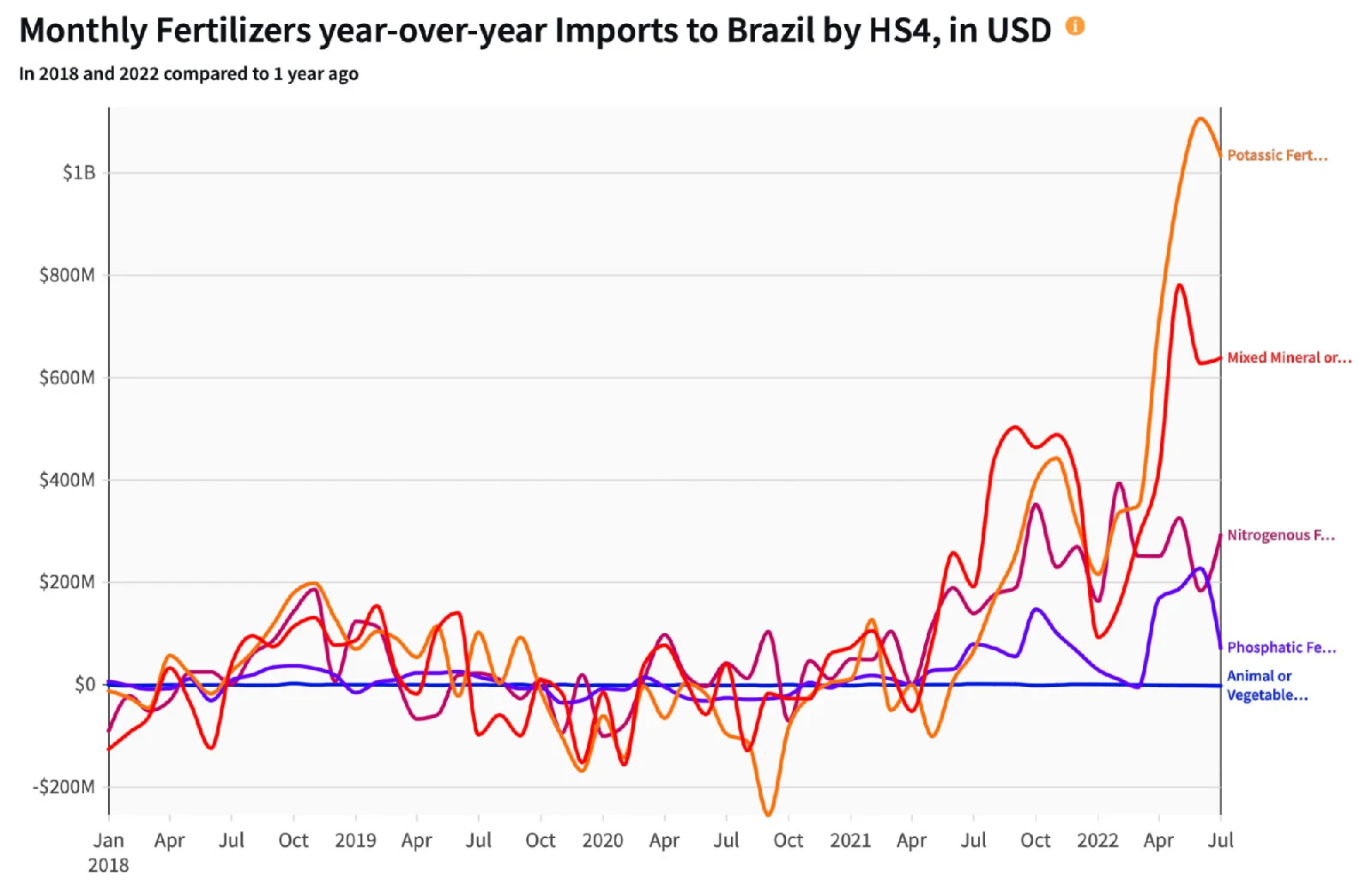

By July, Brazil's imports of potassic fertilizer grew by $1.03B (292%) compared to the year before. Rising prices drove the growth in trade value. At the same time, Brazil has started to shift to new suppliers in Israel (↑ 805%), Canada (↑ 454%), and Germany (↑ 324%).

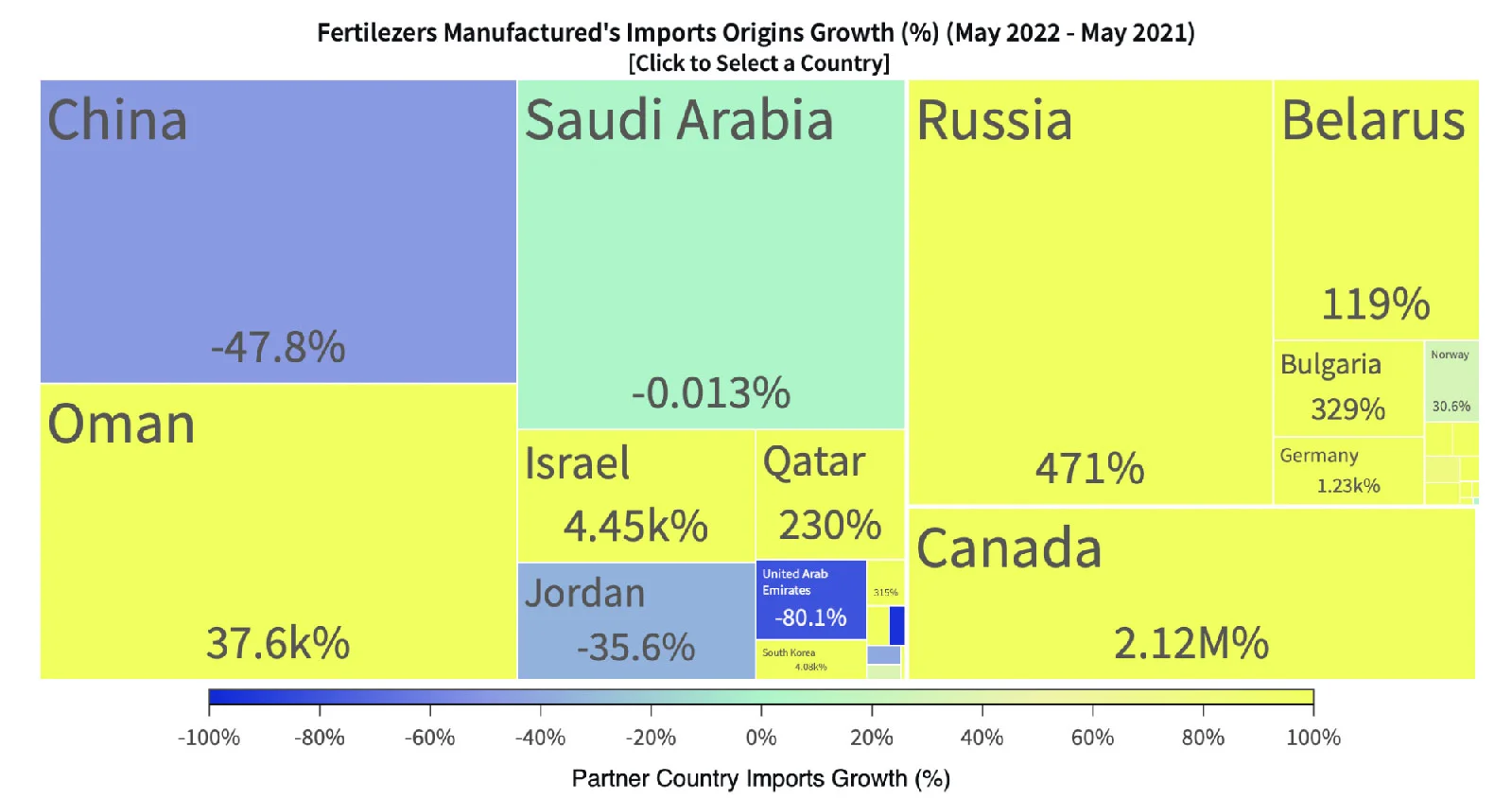

As for India, the country has also shifted away from imports from Russia. By May 2022, India's fertilizer imports from Canada (↑ 2.12M%), Oman (↑ 37K%), and Israel (↑ 4.45K%) increased exponentially in comparison to the year before.

Fertilizer prices in 2022 are at historic highs. As a result, some farmers may have expanded to crops that require less fertilizer, like soybeans. Others may have reduced overall acreage plantings or modified to other methods. However, decent profit margins are still feasible considering the high prices of commodities like corn, wheat, and soybeans.

The major challenge, however, is for those farmers unable to cover rising costs. Last week at the UN, Member States agreed to increase fertilizer production to compensate for shortages and encourage fertilizer innovations and efficiency. The agreement comes as geopolitical and climatic events show the food system's vulnerability.